South Carolina’s 46 counties, as we know them today in terms of governing structure and services, are relatively young in our state’s history. Unlike municipalities that are created to provide specific services, counites are originally created as an arm of the state to only provide state services such as courts, schools and roads. The modernization of county government begins to formally take shape when the SC General Assembly ratifies a constitutional amendment in the 1970s. The following timeline traces the evolution of county government in South Carolina and illustrates the significant impact the Home Rule Act of 1975 has had on today’s counties.

Colonial Days to early 1900s

As evidenced in South Carolina’s constitutions overtime, the provision for county government in terms of forms, powers and duties ebb and flow. During the early years, government is centered in Charleston. Anglican parishes serve as election districts and provide for education, roads and vital statistics.

In the 1868 constitution, judicial and election districts are decreed counties and voters can elect a county board of commissioners to provide for roads and bridges and disbursement of funds for general county purposes. Likely due to the political tensions during the Reconstruction Era, this provision is repealed in the 1890 constitution and is not reinstated in the 1895 constitution, the state’s current constitution. Each county is deemed an election district in the 1895 constitution and has limited authority to assess and collect taxes for “ordinary county purposes” only.

Throughout South Carolina’s history and well into the latter half of the 20th century, counties are largely run from the State House in Columbia. During this time, legislators have expansive power and control over local matters and pass local legislation and local budgets called “supply bills” in Columbia each year.

1930s to 1940s

South Carolina experiences significant population growth spurred by military operations making it difficult for legislators to oversee county concerns and operations while focusing on state issues and policies.

1945 to 1949

At the end of World War II, the Public Administration Service conducts a study of the Charleston area. Recommendations include creating a County Board of Commissioners with the power to levy and collect taxes, control expenditures, incur debt, enter into contracts and pass local ordinances.

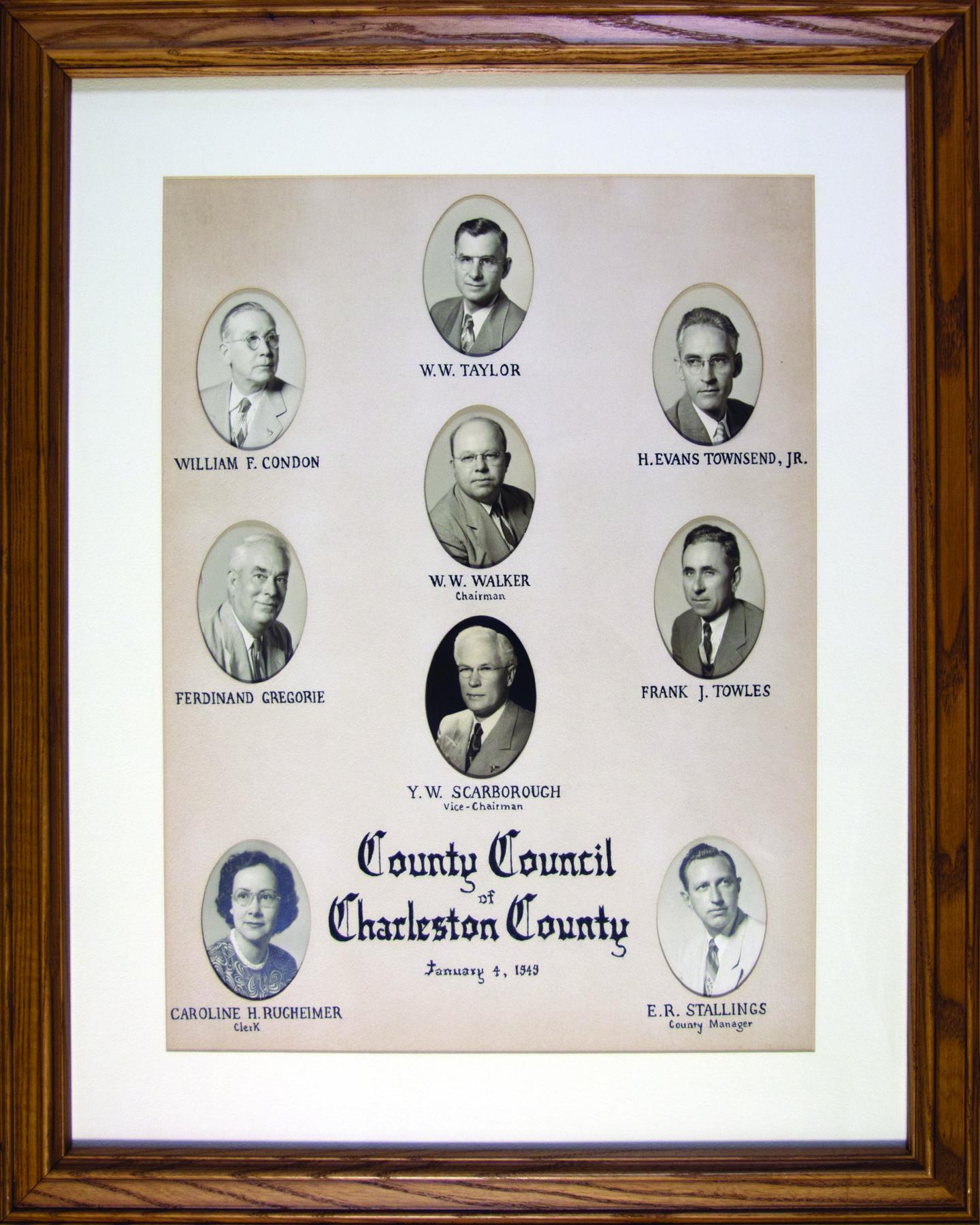

In Act 764 of 1948, the General Assembly authorizes a county council for Charleston County and provides for a referendum, permitting its voters to choose between three forms of government. The following year Charleston County Council members are sworn into office and the council-manager form of government takes root. These events are the cornerstone for a statewide movement toward Home Rule over the next 25 years.

1960s

During this time the federal courts establish the one-man, one-vote concept for electoral representation at the state level which require state legislators to represent more or less equal numbers of people. Because of the varying distribution of South Carolina’s population, some counties lose their resident state senator, and representatives may come from districts crossing county lines.

1964

The Reynolds v. Sims case requires representation in the General Assembly to be based “substantially” upon population. Reapportionment prompts the development of county-based local governing.

There is a growing number of public service-minded leaders and organizations in South Carolina pushing for modernization of local government. A grassroots effort takes place and helps push the movement for home rule.

“…the days of all the details of county government being run by a majority of the delegation including the Senator must inevitably be coming to an end. When our population was smaller, when we were still a rural state, when persons running for the legislature knew most of their constituents by name, government by the Senator and majority of the House — or by the Senator alone… worked remarkably well. Today, however, the problems of county government have become far more complex, far more time-consuming than they were 50, 25 or even 10 years ago,” – Lt. Gov. John C. West, April 13, 1965

1966

The General Assembly creates the Committee to Make a Study of the SC Constitution of 1895. The committee is chaired by Lt. Gov. John West to determine the forms, powers, and duties of local government. The committee issues its final report three years later calling for 17 new articles for the state constitution including one to address local government—one of the more contentious issues.

1967

The General Assembly creates the Committee to Make a Study of the SC Constitution of 1895. The committee is chaired by Lt. Gov. John West to determine the forms, powers, and duties of local government. The committee issues its final report three years later calling for 17 new articles for the state constitution including one to address local government—one of the more contentious issues.

1970s

The General Assembly creates a constitutional revision committee to recommend changes to the state constitution. The recommended local government changes are put before South Carolina voters in the 1972 General Election.

Voters approve the following ballot measure 55.4% to 44.5%:

Shall Article VIII be amended so as to provide for retention of present powers of various local political entities and county boundaries until changed; maximum number of counties; merger of adjoining counties and portions thereof; county seats; governmental aspects of counties; incorporation of new municipalities; various aspects of municipal government; joint financing and administration of functions by the State, local and out-of-state governments and to permit dual office holding in such cases; restriction on political subdivisions in matters of statewide concern; prohibit the General Assembly from granting rights to construct and maintain certain public works and utilities without consent of political entity affected; provide for municipal and county acquisition and operation of public utilities and transportation; provide for construction of constitution and laws; provide for assignment and regulation of territories for electrical and gas utilities in consolidated political subdivisions; and to delete from this article provisions relating to alcoholic liquor and beverages, certain corporate, manufactories and business license taxes and city and town bonded debt limitations?

1973

The General Assembly ratifies and approves Article VIII of the state constitution.

Article VIII, Section 7: The General Assembly shall provide by general law for the structure, organization, powers, duties, functions, and the responsibilities of counties, including the power to tax different areas at different rates of taxation related to the nature and level of governmental services provided. Alternate forms of government not to exceed five shall be established. No laws for a specific county shall be enacted and no county shall be exempted from the general laws or laws applicable to the selected alternative form of government.

It takes an additional three years filled with long debates at the statehouse and court rulings to finally push legislators to pass enabling legislation and home rule for counties over the finish line.

1974

The SC Supreme Court rules in Knight v. Salisbury that a legislative act to form the Lower Dorchester Recreation District is unconstitutional based on the Home Rule Amendments. This ruling means the General Assembly cannot create special districts or pass county-specific legislation.

“It is clearly intended that home rule be given to the counties and that county government should function in the county seats rather than at the State Capitol. If the counties are to remain units of government, the power to function must exist at the county level. Quite obviously, the framers of Article VIII had this in mind.” – Knight v. Salisbury

1975

The court’s ruling in the Booth v. Grissom case concludes that the General Assembly can no longer pass county supply bills because they violate Article VIII of the State Constitution.

Sen. Richard Riley leads the enabling legislation charge by sponsoring a bill that provides for alternate forms, structure, organization, powers, and duties of county government. A conference committee is formed and after long debate both chambers adopt its report on June 12.

Gov. James Edwards signs the Home Rule Act on June 25, 1975. Counties are required to choose a form of government via referendum by July 1, 1976.

1976

The SC Supreme Court rules that the County Board of Commissioners form of government is unconstitutional in Duncan v. County of York. Counties must operate under the remaining four forms of government: council, council-supervisor, council-administrator, or council-manager form of government.

1986

The SC Tort Claims Act codifies the waiver of sovereign immunity for state and local governments and allows limited recovery of damages. The Act also authorizes property and liability insurance pools, allowing counties and municipalities to form intergovernmental agreements for property and liability insurance.

1988

Counties are permitted to offer a fee in lieu of taxes for industrial developments valued at $85 million or more and financed by industrial revenue bonds.

1989

Counties are given the authority to form multi-county industrial or business parks.

In Act 139, counties are expressly granted general police powers. Prior to this, these powers are implied by Article VIII, Section 17.

“The powers of a county must be liberally construed in favor of the county and the specific mention of particular powers may not be construed as limiting in any manner the general powers of counties.” — SC Code Ann. § 4-9-25

1990

Counties and municipalities are authorized the first local government sales tax, permitting local governments to impose a one-cent local option sales tax by referendum.

1991

The SC Solid Waste Policy and Management Act passes requiring counties to develop solid waste plans to reduce landfill waste by enacting programs to increase the recovery and recycling of materials.

Gov. Carroll Campbell signs Act 171, authorizing fiscal impact statements for all legislative bills that require county or municipal expenditures of funds, personnel, equipment or facilities.

The State Aid to Subdivisions Act allocates state-shared revenue to local governments. The Local Government Fund — the largest component of the Act — is allocated per statutory formula to counties and municipalities. Prior to its passage, local governments received a portion of multiple state taxes that varied each year. The purpose of the Act is to create a stable funding source that will increase or decrease proportionately to the state’s general fund.

1992

The Brown v. Horry County ruling upholds an ordinance to impose a road maintenance fee on all motor vehicles registered in Horry County. The SC Supreme Court rules that counties may impose a uniform service fee on users, rather than increasing the general county property tax.

1993

Act 157 passes preventing a law that requires local governments to expend funds unless the General Assembly determines the law fulfills a state interest and is approved by a two-thirds majority in both houses. This is referred to as unfunded mandates.

The Williams v. Town of Hilton Head Island ruling expressly holds that Dillon’s Rule—a doctrine that local governments are creatures of the state and may only perform functions that are delegated by the state—is incompatible with the constitutional Home Rule provisions, particularly Article VIII, Section 17.

1994

The SC Local Government Comprehensive Land Use Planning Enabling Act passes consolidating land use planning for counties, towns and districts into a single process. The new Act encourages more regional cooperation in land use planning activities by multiple jurisdictions.

1995

Local governments are granted the authority to impose a transportation sales tax or toll to finance transportation projects by referendum.

1997

Counties and municipalities are granted three additional local option sales tax provisions: the capital project sales tax, local accommodations tax, and local hospitality tax.

2006

Act 388 restricts local governments’ ability to raise revenue. The Act utilizes the constitutional 15 percent assessment limit over a five-year period and imposes a cap on local government millage rates. It also exempts residential property owners from paying school operating millage.

2013 to 2014

SCAC joins NACo, the International Municipal Lawyers Association, and several state and county solid waste authorities in the fight to protect local governments’ management of solid waste. The Fourth Circuit Court of Appeals affirms a District Court decision in Sandlands v. Horry County ruling in favor of Horry County.

2021 to 2022

In Burns v. Greenville County, the SC Supreme Court rules that road maintenance fees imposed on all automobile owners in the county are not user fees but a tax, thus making many existing county fees improper. In response to the Burns decision the General Assembly passes Act 236 which clarifies that counties can impose user fees, especially road user fees.

The Rural Stabilization Fund is created by proviso to provide state revenue to counties that have population growth, as determined by the 2020 Census, of less than 5.35% since the 2010 Census.

In Act 166, counties are granted authority to impose a Green Space and Use Tax up to one percent for land preservation as approved by referendum.

The following references have been used for this timeline:

Government in the Palmetto State – Toward the 21st Century, Edited by Luther F. Carter and David S. Mann. South Carolina: Institute of Public Affairs, The University of South Carolina, 1992.

A Handbook for County Government in South Carolina, Revised Fifth Edition. South Carolina: South Carolina Association of Counties, 2014.